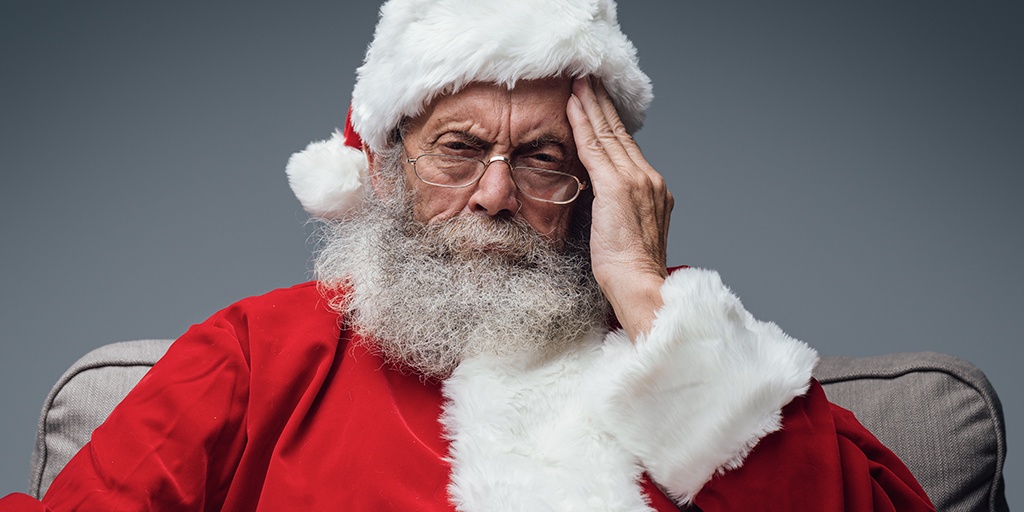

For many businesses it’s an all-too familiar story. A perfect storm that blows in every single year.

When times are good, it can be manageable. But when there’s a recession (or sluggish recovery from one), the impact can be devastating. It often plays out like a car crash in slow motion. You see it happening, but are helpless to stop it.

It’s a collision of 3 terrible forces, actually: increased costs, decreased efficiency, and paralyzed accounts receivable. But there is a solution.

First, you need to recognize what is happening. The holiday season is NOT like the rest of the year. An unholy trinity of dynamics come into play amidst all the cheer, generosity and brotherly love:

Increased Costs

Over the holidays, businesses have staff parties, corporate gifts, custom cards, open houses and holiday bonuses to pay for. Many don’t budget for, or grossly underestimate all the festive season’s expenses.

Decreased Business Efficiency

You know it happens. Staff sneak in extra errands on work time, do their online shopping and troll social media for gift ideas from the office computer. They stay up later at night, drink in plenty of holiday cheer, and some come to work run-down or hungover. Oftentimes a holiday bug makes its rounds. That last week before Christmas break, little gets done. And then there’s the break itself!

Paralyzed AR

How tough is it to bring in Accounts Receivable immediately before Christmas? Doing so is quick to stir up references to the Grinch or Ebeneezer Scrooge. Suddenly, YOU’RE the mean one for wanting to be paid the money owed to you. But it gets worse. If you’ve ever tried collecting debt during the bleak and remorse-filled days after Boxing Week, you’ll have experienced a whole new kind of sadness.

READ: Beat the Christmas Collection Crunch

Simply put, you don’t want to be making collection calls in December or January that should have been made earlier. Even my agency—and we’re full-time professional debt collectors—don’t go chasing people during their holiday feast or family gift exchange. It’s not appropriate and can reflect badly on your brand.

TIP: You can send us your overdue accounts anytime, including Christmas Day, using our unique online MyMetcredit tool. It’s productive, and will tidy up your to-do list, but we won’t be able to help until a few days later. (Yep, in January.)

So what’s a smart business owner to do? The number one secret to avoid kicking off the new year with a debt collection hangover is being proactive. That means acting NOW!

Review all your outstanding receivables, and flag those that will cross the line in the next few weeks. Start following up right away.

If you encounter resistance or red flags that indicate a bad debt is imminent, send the account to your collection agency. There’s probably a good chance of recovering the debt before the holidays hit.

For more tips and techniques on collecting during the holiday season, read this helpful post.

Be sure to download my 10 Pro Debt Collection Tips for free with the link below, or contact me or my debt collection experts if you need professional advice. There’s never any obligation.

And have a joyous, stress-free holiday season!